The model

The model of autonomous financing agreed in 2009 provides for three revenue tracks: a) taxes ceded; b) an equalisation mechanism; and c) three adjustment funds.

1. Taxes ceded

The state cedes 100% of the collection of the following taxes:

• Wealth tax

• Inheritance and gift tax

• Tax on capital transfers and document legal acts

• Taxes on games (i.e., lottery, raffle, game shows)

• Excise duty on certain means of transport

• Online gambling taxes

• Landfill taxes

• Bank deposit taxes

• Tax on electricity

And the following:

• 50% of the Personal Income Tax

• 50% of the Value-Added Tax

• 58% of Excise Taxes on the production phase of alcohol, tobacco and hydrocarbons

For more information, proceed to page 31 of this link

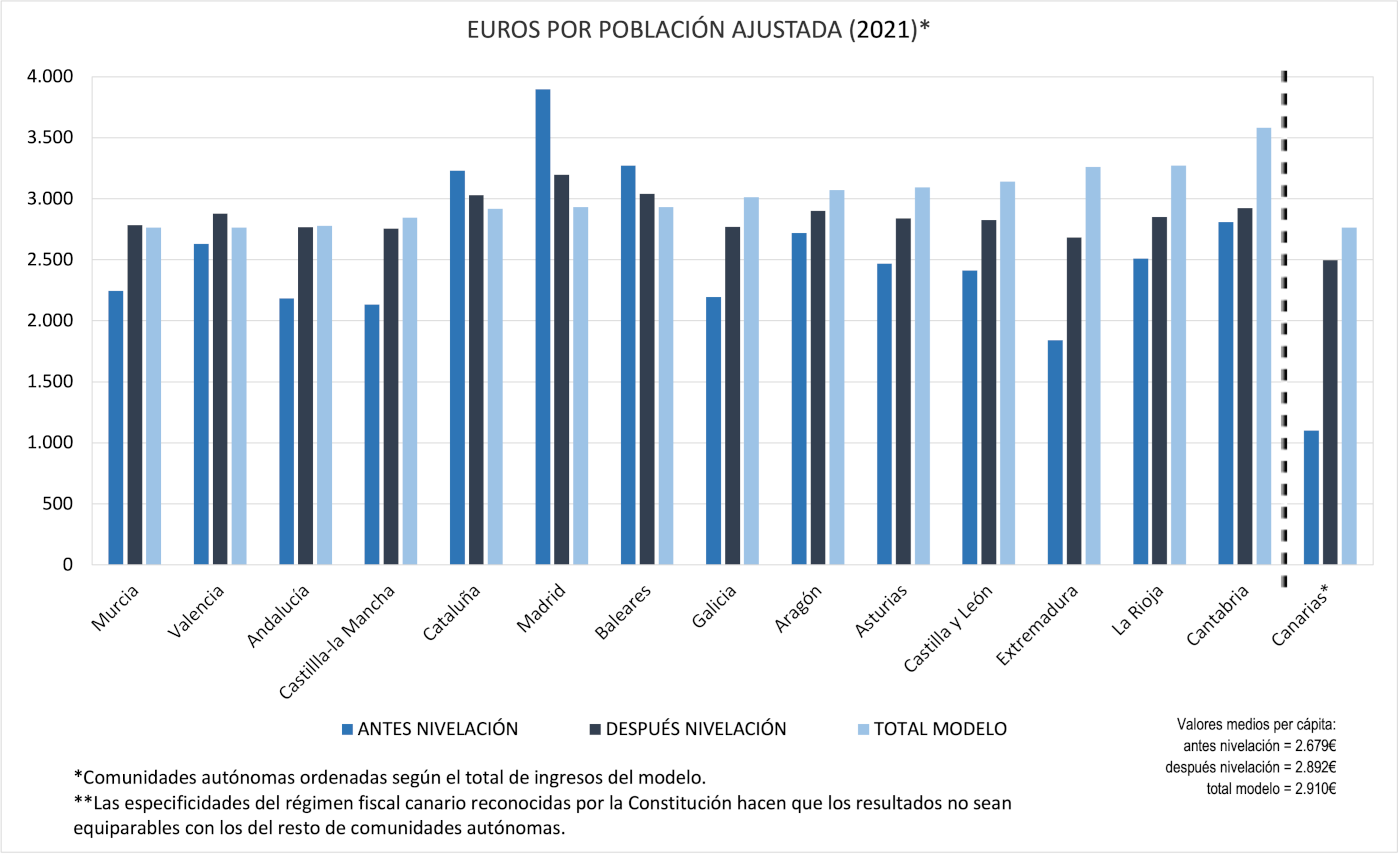

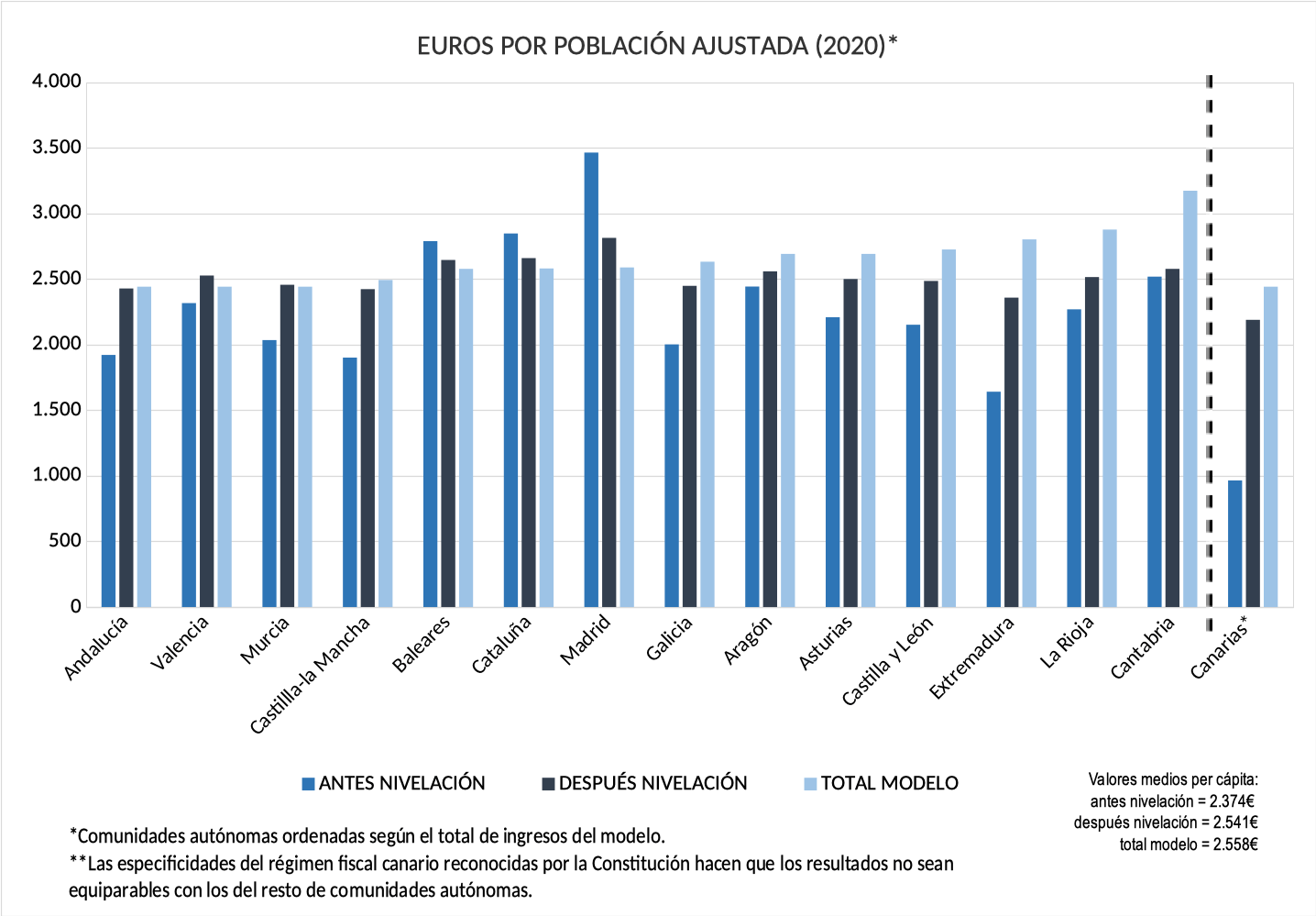

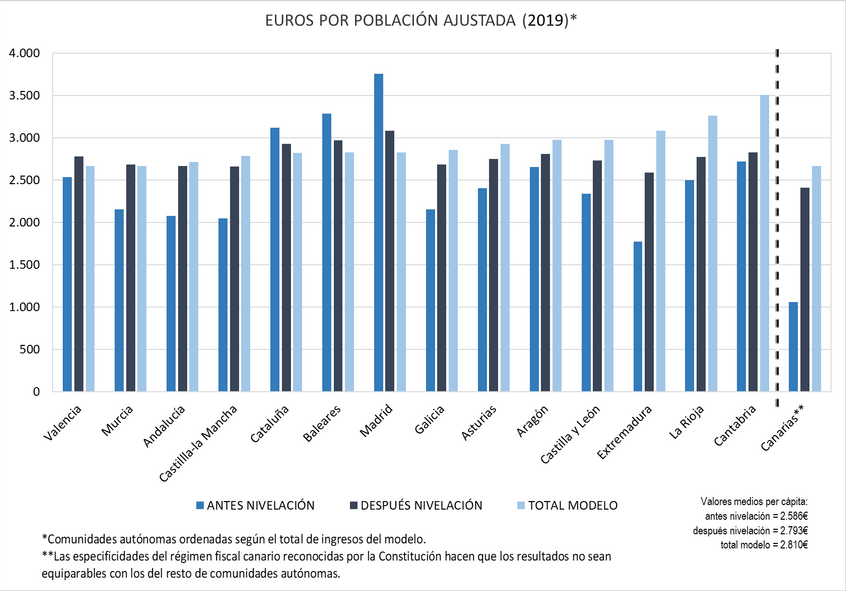

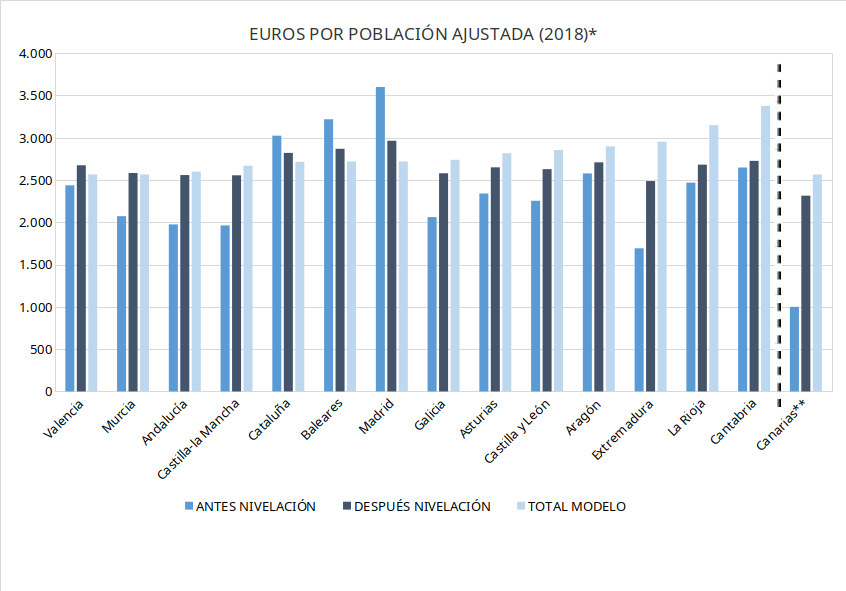

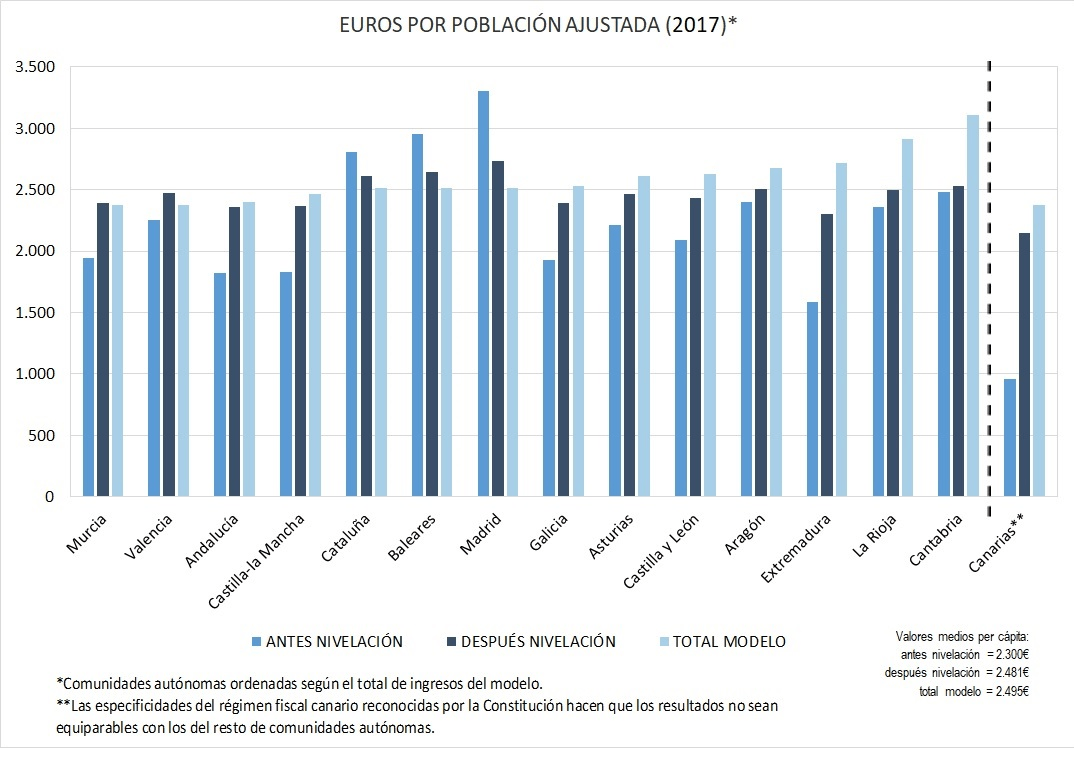

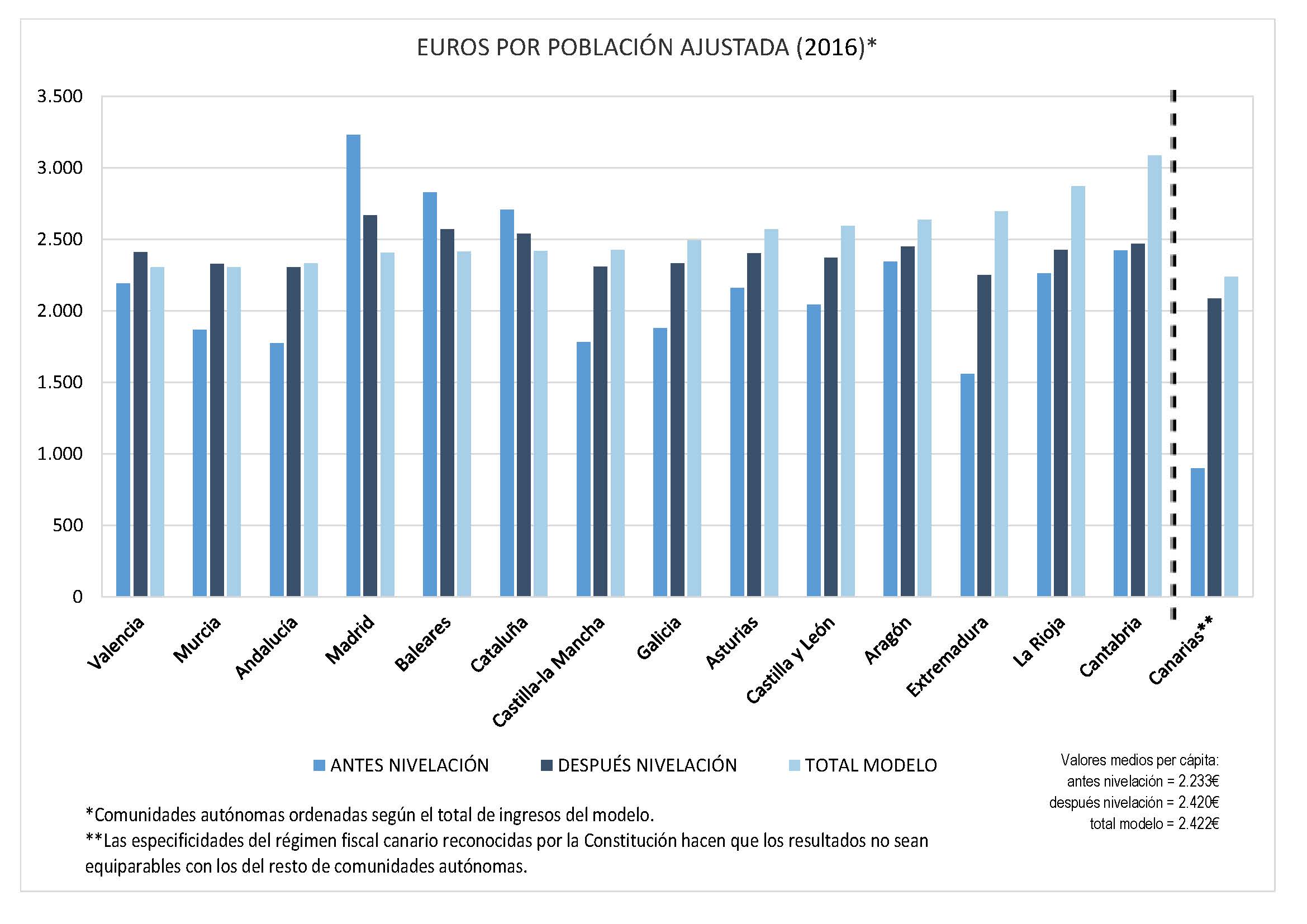

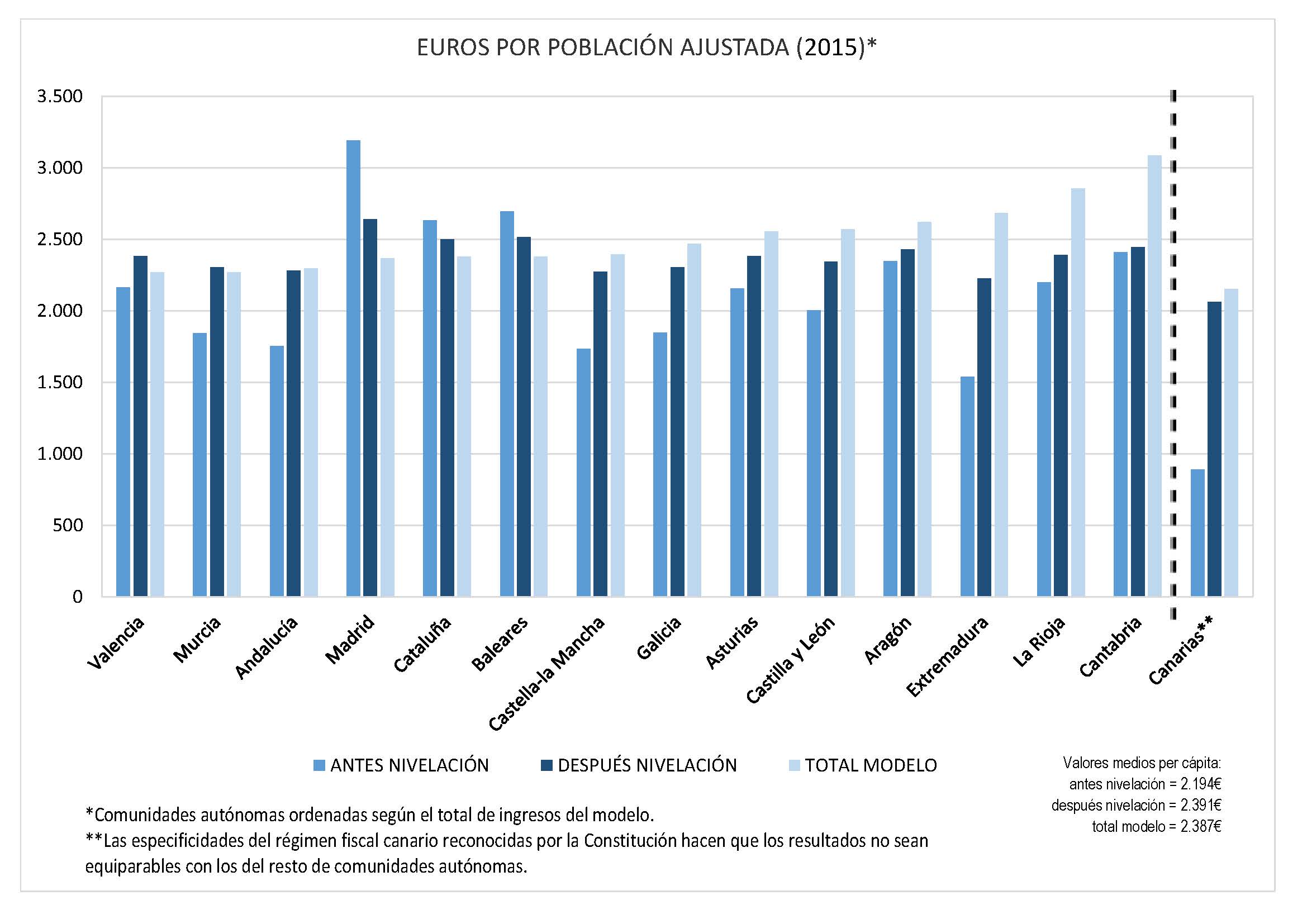

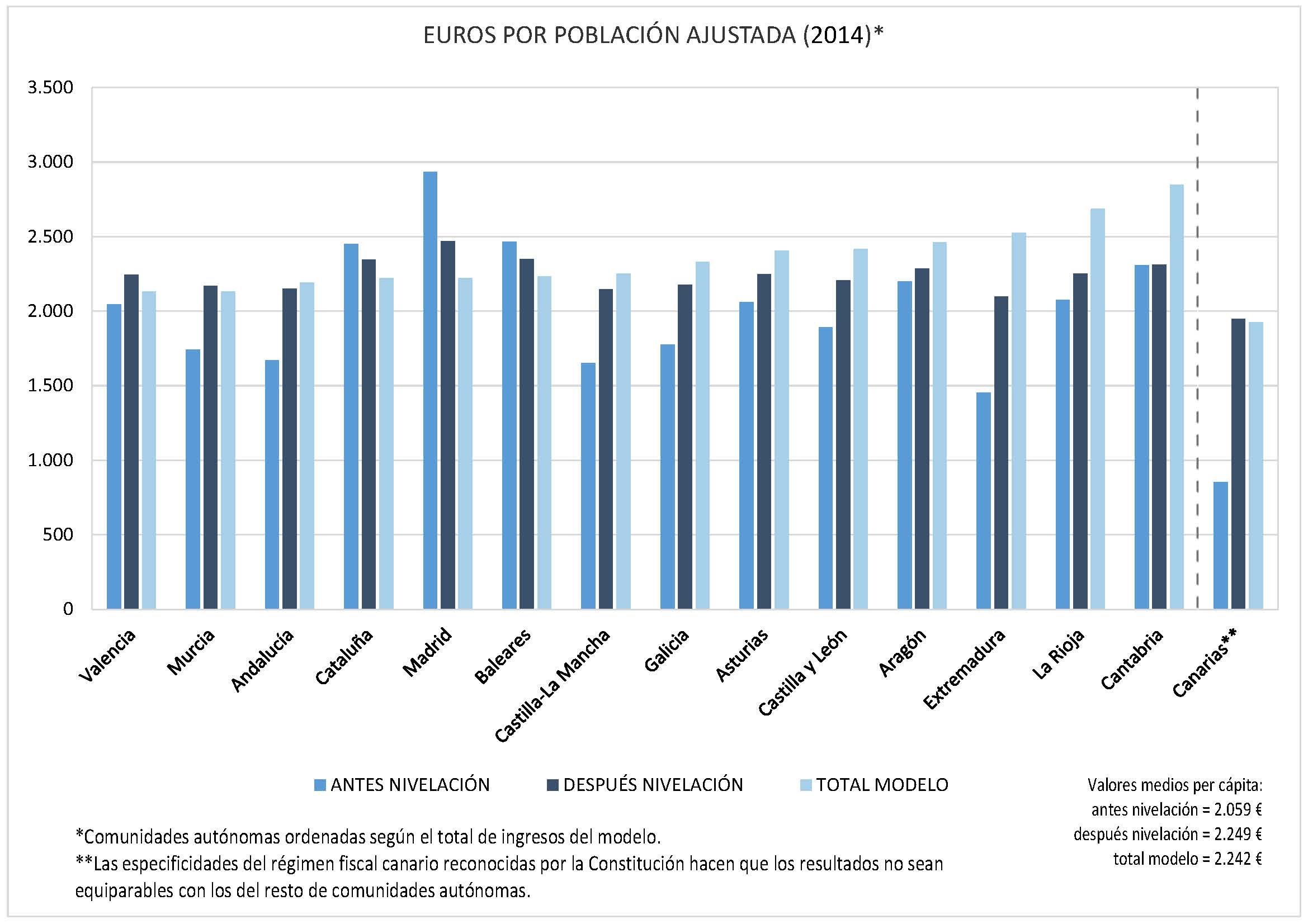

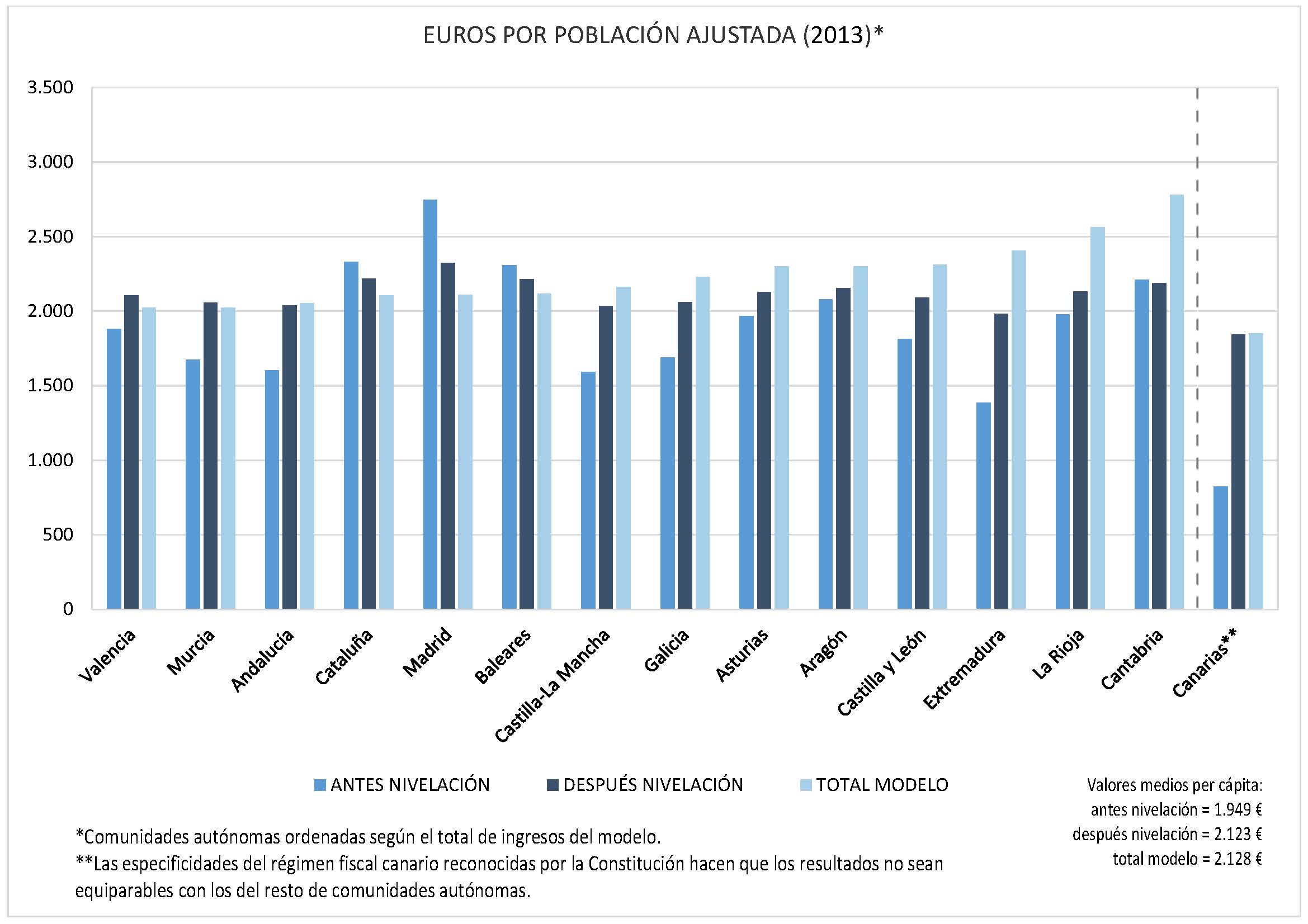

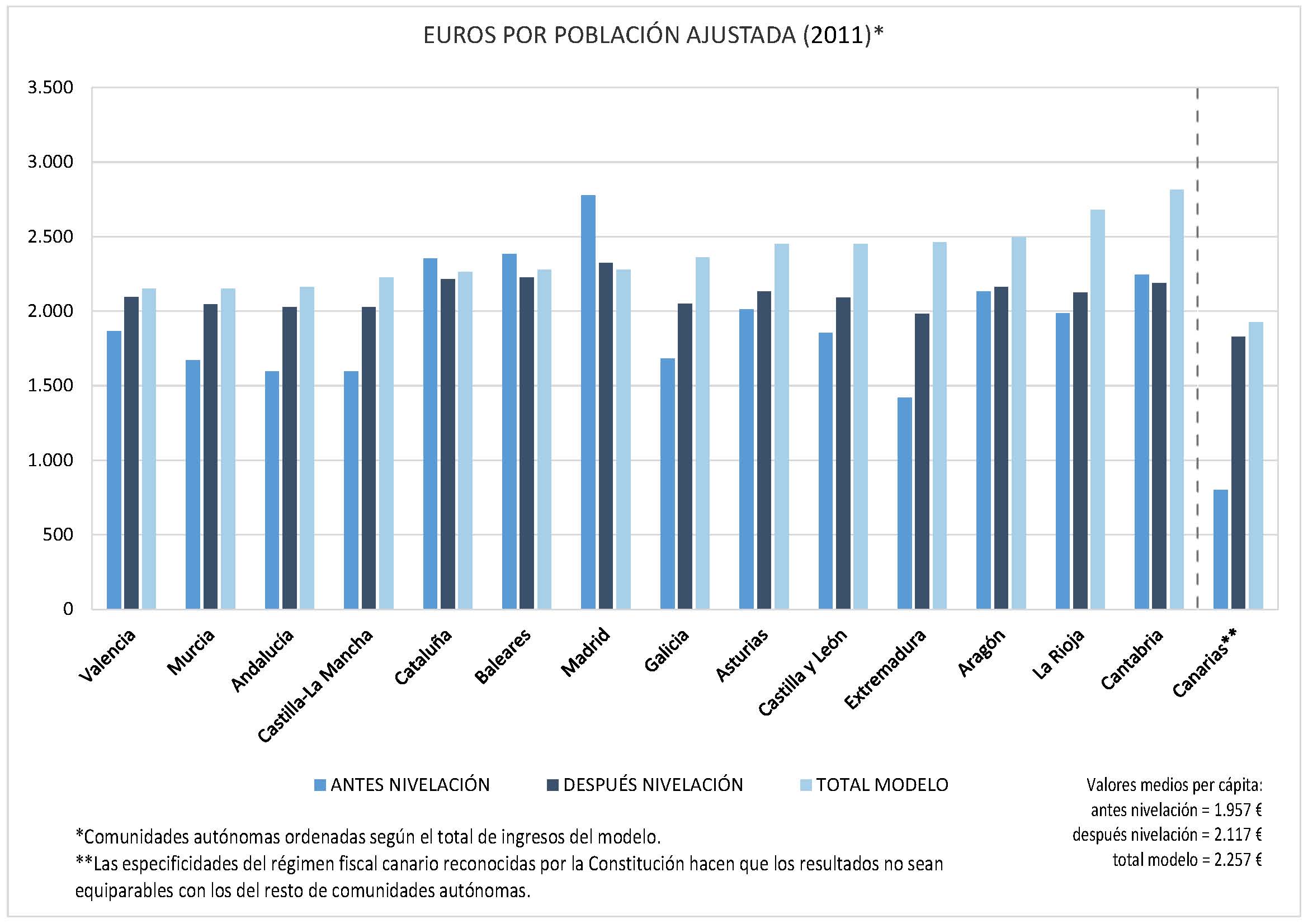

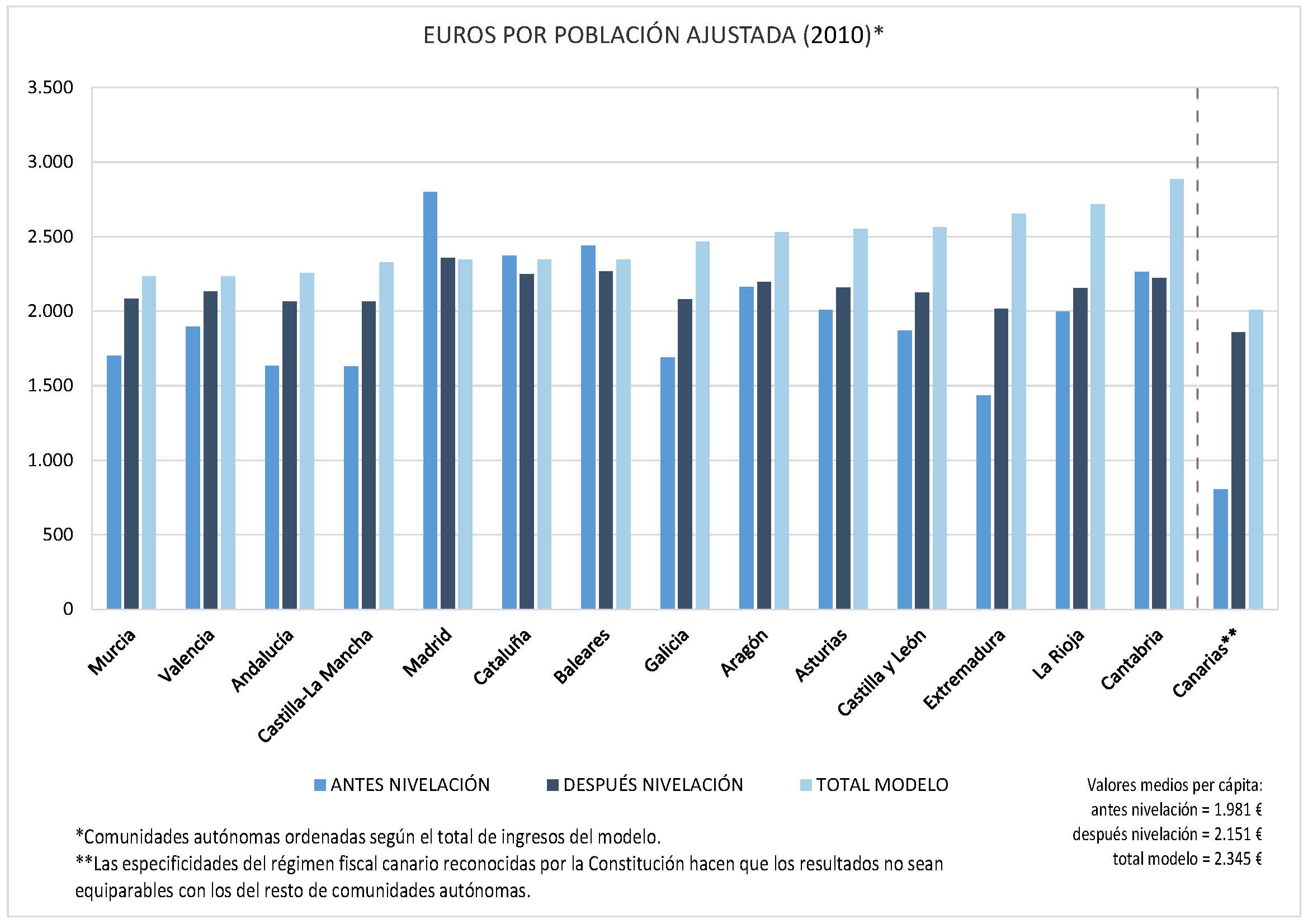

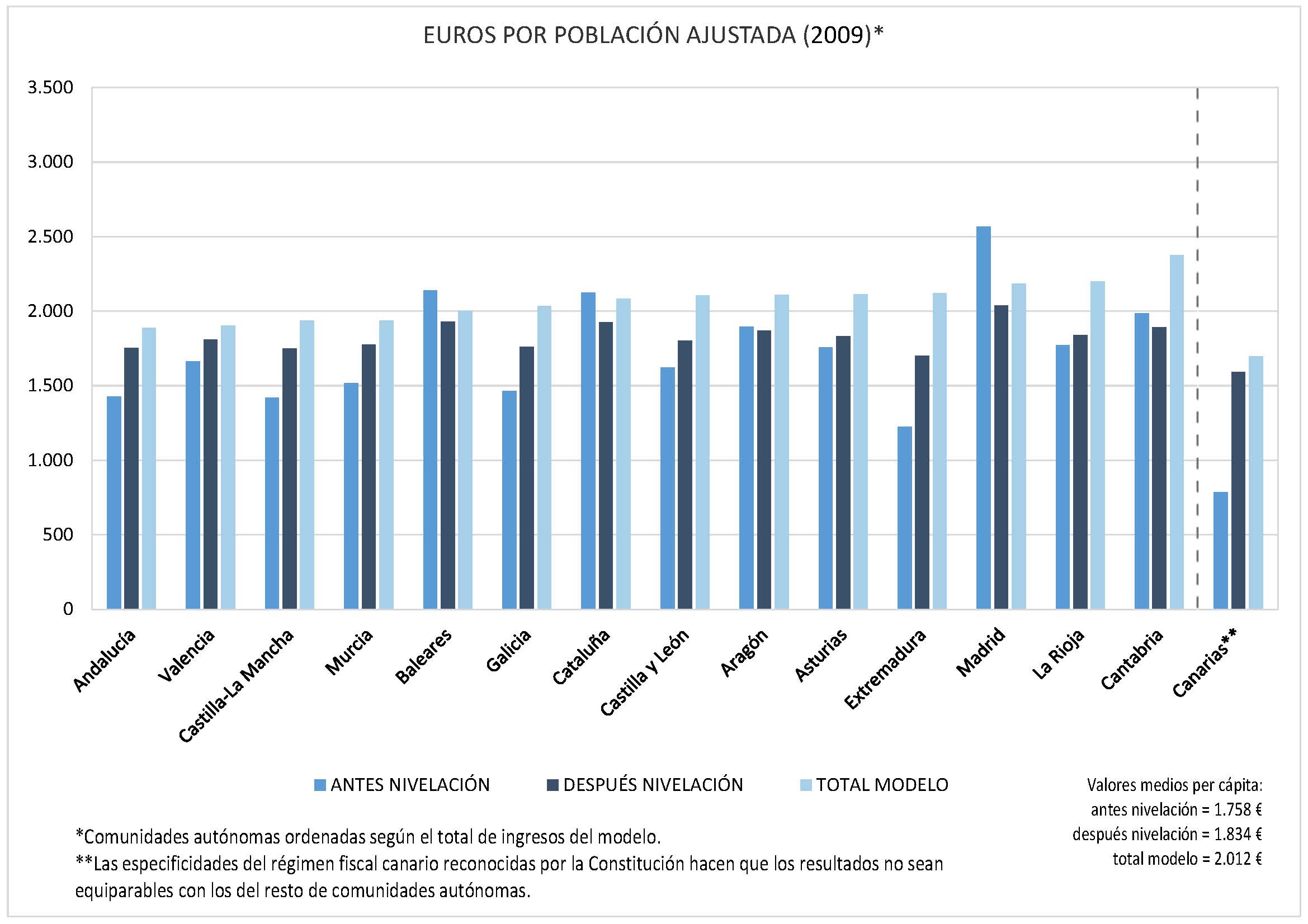

2. Equalisation mechanism

To comply with the principle of inter-territorial equity, an equalisation grant is implemented under the name of the Guarantee Fund of Basic Public Services (FGSPF). The objective is to ensure that each autonomous community receives the same resources per capita to finance the essential services of the welfare state (education, health, and social services) doing the same fiscal/tax effort.

3. Adjustment Funds

The objective of the sufficiency fund is to ensure that no autonomous government will lose resources with respect to the previous phase of the model. The competitiveness fund seeks to reduce the financing gaps, in per capita terms, between the communities. While, the purpose of the cooperation fund is for regional development.