Highlights

2024/04: Discovering tax decentralization: Does it impact marginal willingnes...

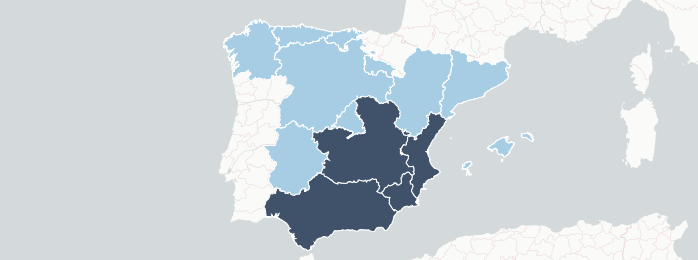

Decentralized fiscal decision-making should serve to enhance welfare by promoting allocative efficiency gains and fostering...

2024/03: Muddying the waters: How grade distributions change when university ...

We analyse how grade distributions change when higher education evaluations transition online and disentangle the...

Report IEB 2023

The IEB Report on Fiscal Federalism and Public Finance is published every year, since 2009,...

2024/02: Can teachers influence student perceptions and preferences? Experime...

We explore the impact of university teacher-student interactions on student perceptions of, and preferences with...

IEB Report 4/2023: Education Policy: Quality and Equality of Opportunity

Market economies inevitably come with economic inequality. However, economic inequality today depends not only on...

2024/01: Issue brief: Making jobs out of the energy transition: Evidence from...

Vast amounts are being invested in the energy transition worldwide, with optimistic expectations of economic...