Destacats

Mapes del finançament

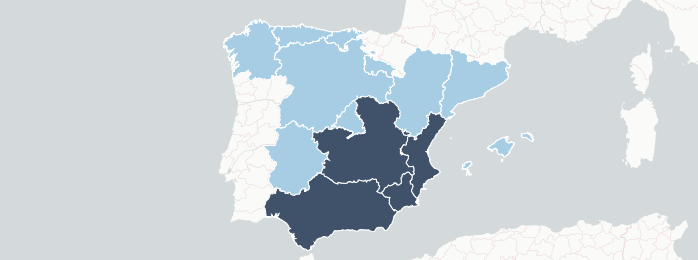

El model de finançament autonòmic acordat en 2009 contempla tres vies d'ingressos

2024/04: Discovering tax decentralization: Does it impact marginal willingnes...

Decentralized fiscal decision-making should serve to enhance welfare by promoting allocative efficiency gains and fostering...

2024/03: Muddying the waters: How grade distributions change when university ...

We analyse how grade distributions change when higher education evaluations transition online and disentangle the...

Informe IEB 2023

L’Informe IEB sobre Federalisme Fiscal i Finances Públiques es publica cada any, des de 2009,...

2024/02: Can teachers influence student perceptions and preferences? Experime...

We explore the impact of university teacher-student interactions on student perceptions of, and preferences with...

IEB Report 4/2023: Polítiques educatives: qualitat i igualtat d’oportunitats

Les economies de mercat van acompanyades inevitablement de desigualtats econòmiques. No obstant això, la desigualtat...

2024/01: Issue brief: Making jobs out of the energy transition: Evidence from...

Vast amounts are being invested in the energy transition worldwide, with optimistic expectations of economic...