Destacados

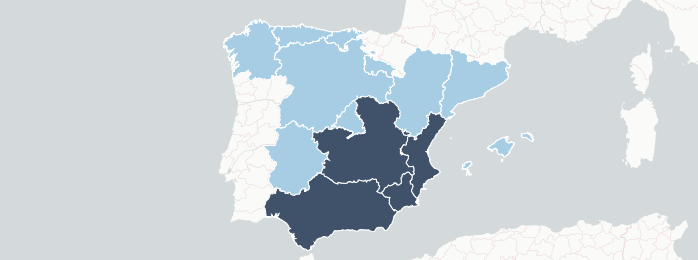

Mapas de la financiación

El modelo de financiación autonómica acordado en 2009 contempla tres vías de ingresos

Informe IEB 2023

El Informe IEB sobre Federalismo Fiscal y Finanzas Públicas se publica cada año, desde 2009,...

2024/02: Can teachers influence student perceptions and preferences? Experime...

We explore the impact of university teacher-student interactions on student perceptions of, and preferences with...

IEB Report 4/2023: Políticas educativas: calidad e igualdad de oportunidades

Las economías de mercado vienen acompañadas inevitablemente de desigualdades económicas. Sin embargo, la desigualdad económica...

2024/01: Issue brief: Making jobs out of the energy transition: Evidence from...

Vast amounts are being invested in the energy transition worldwide, with optimistic expectations of economic...

2023/13: Gender differences in high-stakes performance and college admission...

The Gale-Shapley algorithm is one of the most popular college allocation mechanism around the world....

2023/12: Resilience-thinking training for college students: Evidence from a ...

We conducted a randomized evaluation of a universal primary prevention intervention whose main goal was...